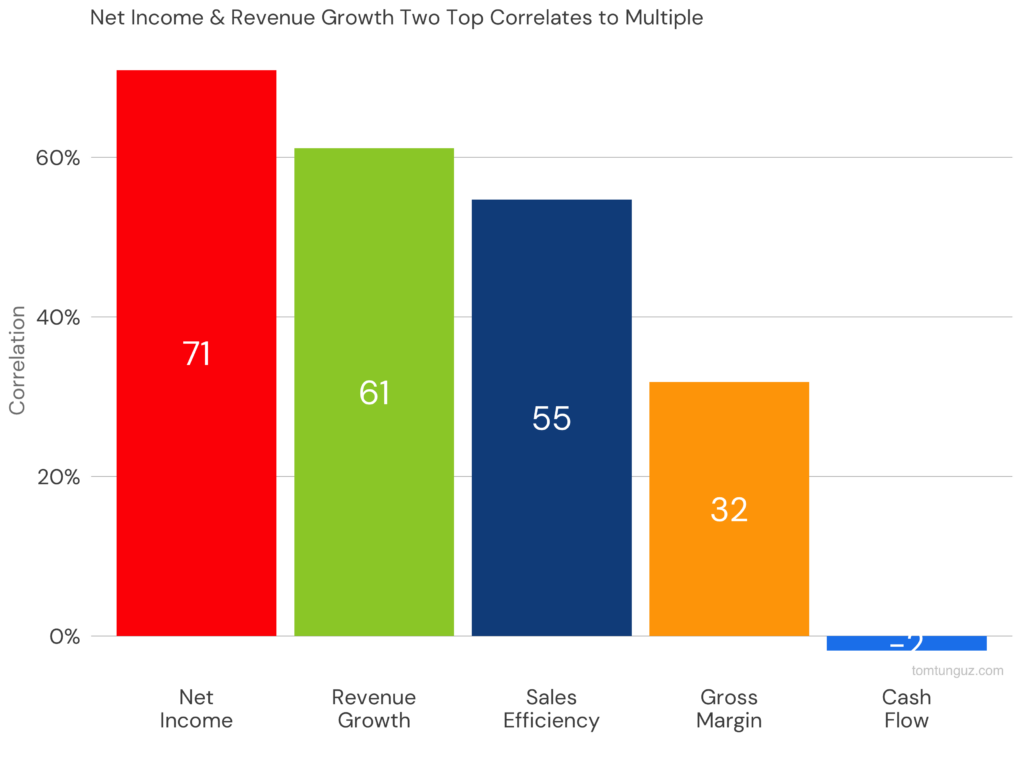

In 2015, the correlation between startup profit and its valuation was negative. So that way, a startup that did not want to spend all its profit and did not get into debt to grow for the sake of growth was evaluated cheaper than its unprofitable counterpart with the same revenue.

In 2020, this correlation has become positive and a bit noticeable at the level of 12%.

In 2022 it grew as high as 71%. In simple words, it means that non-profitable startups, mostly, have lost their chance for a good evaluation.

The upside is that now you can start a startup if you want to make a profit. And people won’t point fingers at you, saying that you are not a real startup then.

Meanwhile, to have the right to be called a startup these days, you need both: have a profit and continue to grow.

The dependence of a startup valuation on the revenue growth rate has even dropped from 81% in 2020 to 61% in 2022, but a startup having “weight” in the valuation is almost the same as its profitability.

You can think that the task has become more complicated. However, the gist of a startup just returned to the concept of a regular running business.

The image is taken from Tomasz Tunguz’s blog from Redpoint Ventures.